When you are consumed with debt, it can be depressing. You wonder to yourself how you got in this predicament and it becomes impossible to shake off those feelings of shame and guilt. Many people suffer in silence, too embarrassed to reveal to friends and family about their debt, but it should be noted you are not alone. In 2017, it was reported that the average American household carries a whopping $137,063 in debt! Although it seems like a large amount, it is important to know that there is a way out. Whether it’s credit cards, student loans, or a combination of auto and mortgage loans, read these guidelines to help pave your way out of debt.

Get Real With Yourself

It’s impossible to get out of debt if you don’t know what you owe. Take a moment to sit down and research every lender you are in debt with. You need to know how much you owe and to who and what the interests rates are. List the accounts in order, starting with the one with the highest interest rate. Having a concrete list of everything can help you realize your debts aren’t as out of control as you think.

Be Proactive

If the interest rates on your debt are giving you anxiety, just breathe. Call each lender and explain your situation. If it’s for credit cards, ask if you qualify for a financial hardship program or try to negotiate a lower interest rate. If it’s for student loans, inquire about government repayment programs or deferment options until you can get back on your feet.

Put Your Plan Into Action

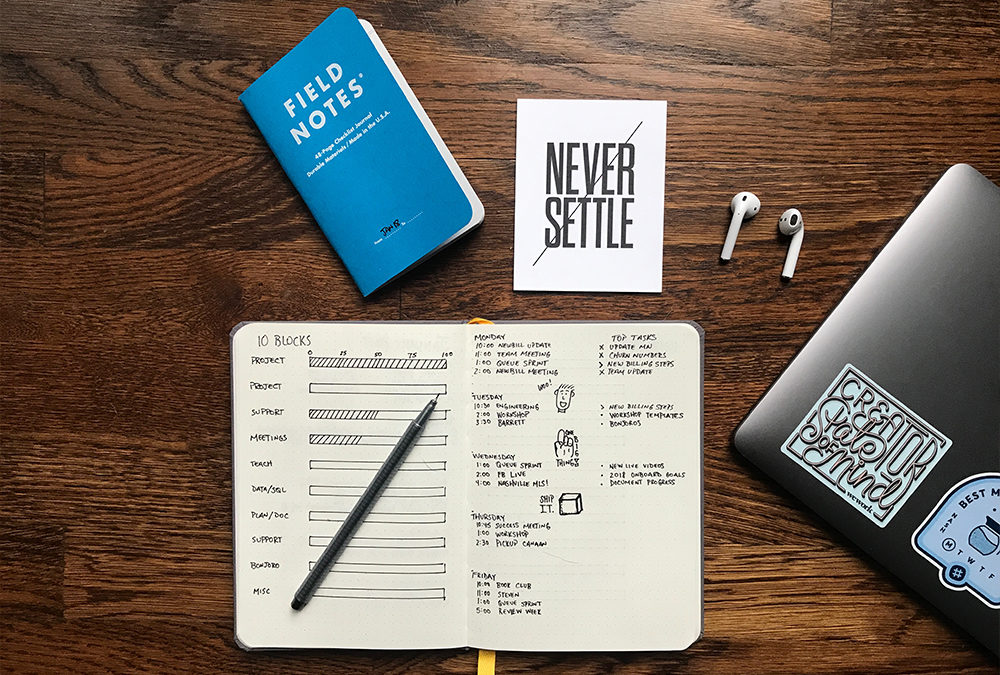

Now that you have a concrete number, it’s time to formulate a plan to get rid of your debt. Calculate your expenses and formulate a budget. There are plenty of resources to help you get started on a budget, as described here. Once you see your expenses, figure out where you can cut back or commit to increasing your income.

Attack Your Debt With A Vengeance

Allocate every extra penny you have towards your debt. It is recommended to pay off highest rate debt first. You will be amazed at how quickly you are able to tackle bills one by one. Set monthly goals towards your progress. Although there may be setbacks, never lose sight of your end goal.

You won’t get rid of your debt overnight. It’s easy to establish a simple plan but your execution is key. If you find yourself drowning in debt and don’t know where to turn, please reach out to Shoreline LF. We specialize in helping people in financial distress and we are here to help you succeed. Do not hesitate to contact us today!